nj property tax relief check 2020

Taxes are due February 1 May 1 August 1 and November 1. All property tax relief program information provided here is based on current law and is subject to change.

Real Property Tax Howard County

Property taxes are billed once a year in either late July or early August and contain 4 quarterly tax payment coupons.

. You can still file for the 2021 Senior Freeze. The deadline for 2021 applications is October. Only for the August quarter you will receive a separate estimated tax bill mailed in June.

Save Time - Sign up to auto draft your tax payments now. By resolution Moorestown permits a 10 day grace period. Requests for special and supplemental relief must be received in the state office on or before december 1st in order to be acted on for the 2022 year.

You are considered the owner of the property if you have life estate rights or hold a lease for 99 years or more. Feb1 May 1 Aug. If you need help documenting your veteran status call.

2021 Senior Freeze Applications. PROPERTY TAX RELIEF PROGRAMS. Property Taxes Site Fees.

If you have questions call your local assessor or tax collector or call the Division of Taxation at 609-292-7974. Handbook for New Jersey Assessors Chapter Four Contact. Delinquent sewer charges accruing between March 9 2020 and December 31 2021 that had been sold at tax.

2020 and March 15 2022. New Jersey Property Tax Benefits Brochure. All relief approvedgranted during 2022 must be paid out by 12312022.

Life Estate Life Tenancy. Tax and Sewer Payments The WIPP system allows homeowners to pay via e-check or ACH for a nominal fee and also accepts creditdebit card payments. The 2020 property taxes must have been paid by June 1 2021 and the 2021 property taxes must be paid by June 1 2022.

5 April 4 1964. New Jersey Department of Military and Veterans Affairs 609-530-6958 or. The 3rd quarter 2022 relief paid report is due by october 30th.

Payments-in-Lieu-of-Tax payments to your municipality. Your site fees must have been paid by December 31 of each year respectively. You must include with your application a copy of an official document eg deed lease establishing your right to occupy the.

Property Tax Bills Property tax bills are mailed once a year in September and contain four quarterly payment stubs. There is no carryover of approvals or granted amounts to 2023.

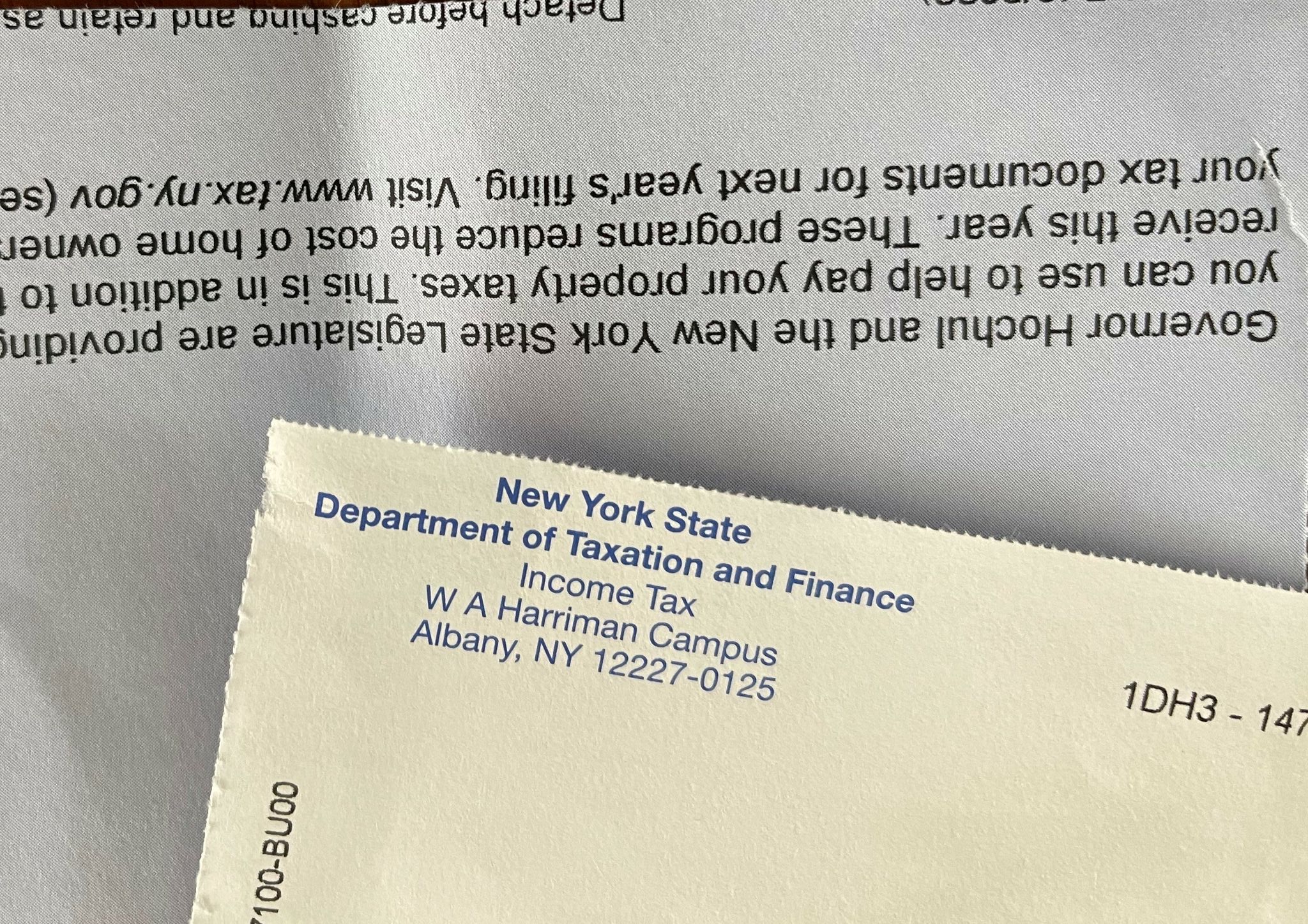

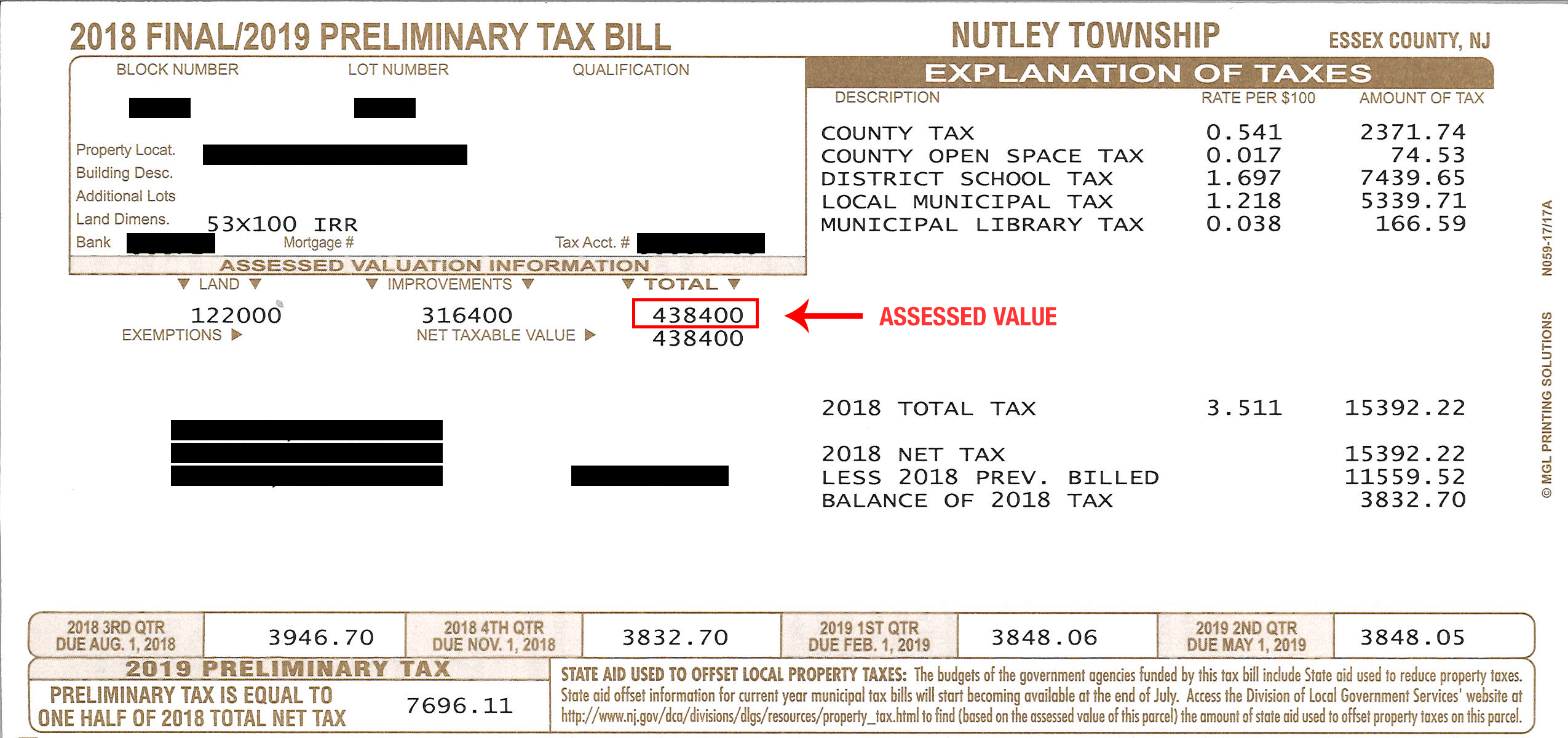

New York Property Owners Getting Rebate Checks Months Early

Stimulus Update New Jersey Homeowners Could Earn Up To 1 500 In Property Tax Relief Who Qualifies Gobankingrates

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

The Official Website Of The City Of Garfield Nj Tax Collector

2022 Property Taxes By State Report Propertyshark

N J Now Has 2b In Property Tax Relief What You Need To Know And How To Get Your Rebates Nj Com

Nj Property Tax Relief Program Updates Access Wealth

New York Property Owners Getting Rebate Checks Months Early

New York Property Owners Getting Rebate Checks Months Early

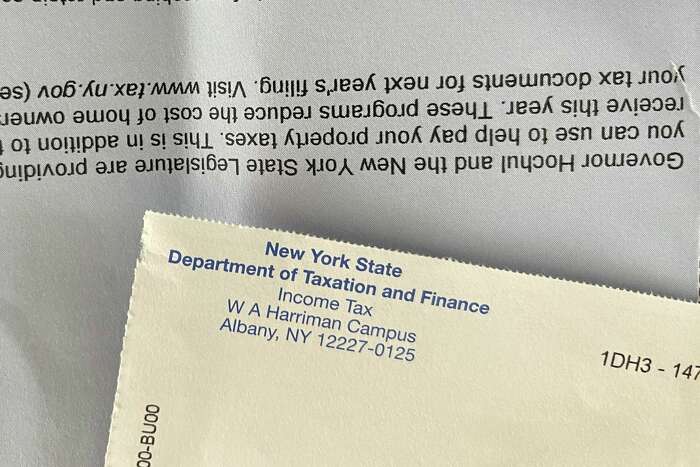

Township Of Nutley New Jersey Property Tax Calculator

What Are Personal Property Taxes Turbotax Tax Tips Videos

Nj Property Tax Relief Program Updates Access Wealth

Stellar Awards 2022 Atlanta In 2022 Atlanta Its All Good Radio

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Property Tax Relief How It Works Credit Karma

Deducting Property Taxes H R Block

Nj Property Tax Relief Program Updates Access Wealth

Murphy Announces Details Of Property Tax Relief Program Whyy